Loading... Please wait...

Loading... Please wait...- Home

- Solaris Blog

- New Jersey Solar Rebates and Incentives

Products

New Jersey Solar Rebates and Incentives

Posted by Brandi Casey on 24th Mar 2017

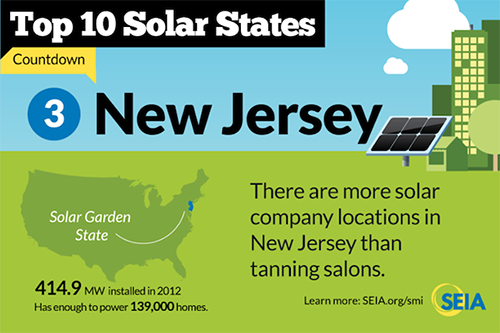

New Jersey had the hard-earned title of the strongest state for solar in 2011 due to its aggressive renewable energy incentive and rebates, since then its rate of growth has continued in an upward trend. The state waives sales tax for solar panels, reduces property tax, provides rebates and offers production incentives to commercial and residential properties that purchase renewable energy systems with a range between $100 to thousands; depending on the system and program. The state was also the first to enact the now widely popular Renewable Energy Portfolio Standard (REPS). New Jersey’s REPS require utility companies to get 20.38% of their power from Class I and Class II renewable energy sources by 2021, and 4.1% from solar by 2028.

Their Solar Renewable Energy Certificate Registration

Program allows utilities whose production portfolio does not meet the mandate

to certificates from renewable producers to offset their non-renewable

production. This is highly beneficial not only for the utility companies, but

for residents who are spared from compensating utilities for their excess

energy. Like many leaders in renewables, the state also has a strong net

metering policy that assists homeowners in offsetting their initial cost of

solar, and financially benefits them by compensating them for their excess

energy production.

Financial Incentives and Rebates

| Industry Recruitment / Support: |

|

| Other Incentive: |

|

| PACE Financing: |

|

| Performance-Based Incentive: |

|

| Property Tax Incentive: |

|

| Sales Tax Incentive: |

|

| State Grant Program: |

|

| State Loan Program: |

|

| State Rebate Program: |

|

| Utility Grant Program: |

|

| Utility Loan Program: |

|

| Utility Rebate Program: |

|