Loading... Please wait...

Loading... Please wait...Products

- Heating and Cooling

- Outdoor Living & Patio

- Solar Kits

- Solar Products

- Solar Panels

- Solar Panel Kits

- Solar Generators

- Inverters

- Inverter Monitoring

- Inverter Accessories

- Balance of Systems

- Racking and Mounting

- Rails

- Flashings

- Splice Kits

- Stopper Sleeves

- Conduit Mounts

- Attachments

- Brace Assembly

- Base Mount

- Brackets

- Bolts

- Clamps

- Caps

- L-Feet

- Washers

- Skirt

- Lugs

- Tilt Legs

- Hooks

- Stand-Offs

- Ballast Bay

- Top of Pole Mount

- Side of Pole Mount

- Flush Mount Kits

- Ground Mount Kits

- Roof Mount Kits

- Hardware Packages

- Wire Management

- Batteries

- Battery Accessories

- Charge Controllers

- Tools and Supplies

- View All Products

Rebates and Incentives

Rebates and Incentives

| State and Local Solar Incentives |

|

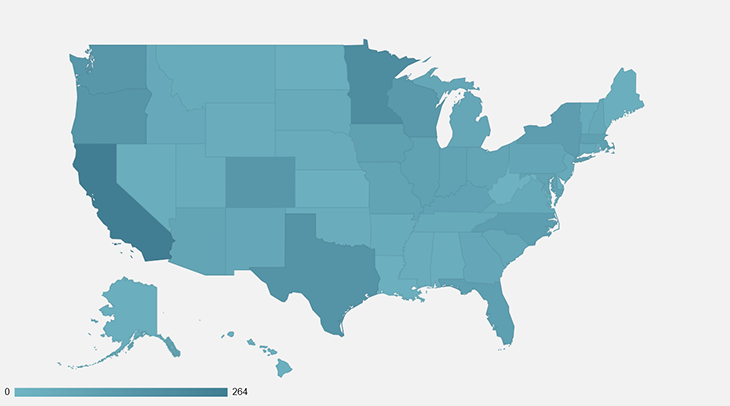

There are many state and local rebates for qualifying solar energy systems that combine with the Federal Tax Credit to help system owners reduce the cost of their PV array. We have outlined these rebates from DSIRE below. *Click the DSIRE US Renewable Incentives Map to see Incentives by State You can also policy incentives by type and state here. |

| How These Incentives Work |

|

All State and Local Incentives, Rebates and Tax Credits work differently - granting you a form of cost assistance either: overtime, based from energy generation, or one-time payments of rebates or credits, among others. Every incentive works differently and may be unique from state to state. Some incentives may affect residential, schools, business, or industrial; or include all of these zones and building types. Furthermore, incentives may apply towards solar photovoltaic, for electricity generated by wind, or for solar thermal, (they may be classified to assist grid-tie systems or off-grid systems as well). State and local solar incentive programs change from time to time, so it’s a good idea to check up on the latest available programs and dates from our US renewable incentives map above. Remember, when qualifying for various programs, different rules exist and your PV array may have to be installed by a licensed Photovoltaic System Installer, and/or connected to the grid by a licensed Electrician, (this may affect grid-tie systems more often). |

| Federal Solar Tax Credit |

|

The 30% Federal Solar Tax Credit also known as the investment tax credit (ITC), allows you to deduct 30 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value. This credit can be utilized for residential and commercial solar energy systems. Other applications include; battery backup systems including one (1) panel or more, product purchases to expand an existing solar array including one (1) panel or more, and solar energy systems for RV and Boats accepted by the IRS as a secondary home are also eligible for qualification. |

| About the Federal Solar Tax Credit |

|

The home the system generates electricity for does not have to be the taxpayer’s principal residence. If the federal tax credit exceeds your tax liability, the excess amount may be carried forward to the succeeding taxable year. There is no maximum on the credit. The credit applies to equipment and installation costs. |

| Tax Credit Amounts |

|

| Understanding the Federal Tax Credit |

|

For Residential Renewable Energy Systems, use IRS Tax Form 5695 to report your expenses. (It can be used for any residence, not just your primary one.) Learn more about residential tax credits. Commercial systems have similar guidelines as residential systems but use IRS Tax Form 3468. Learn more about commercial tax credits. Detailed information regarding the Residential Renewable Energy tax Credit can be found here. Remember, it is important to consult your tax professional or an accountant to coordinate how applying these credits, qualifying, and redeeming will best suit you. |