Loading... Please wait...

Loading... Please wait...Products

- Solar Panels

- Solar Panel Kits

- Solar Generators

- Inverters

- Inverter Monitoring

- Inverter Accessories

- Balance of Systems

- Racking and Mounting

- Rails

- Flashings

- Splice Kits

- Stopper Sleeves

- Conduit Mounts

- Attachments

- Brace Assembly

- Base Mount

- Brackets

- Bolts

- Clamps

- Caps

- L-Feet

- Washers

- Skirt

- Lugs

- Tilt Legs

- Hooks

- Stand-Offs

- Ballast Bay

- Top of Pole Mount

- Side of Pole Mount

- Flush Mount Kits

- Ground Mount Kits

- Roof Mount Kits

- Hardware Packages

- Wire Management

- Batteries

- Battery Accessories

- Charge Controllers

- Tools and Supplies

- View All Products

Solaris Blog - Connecticut Solar Rebates

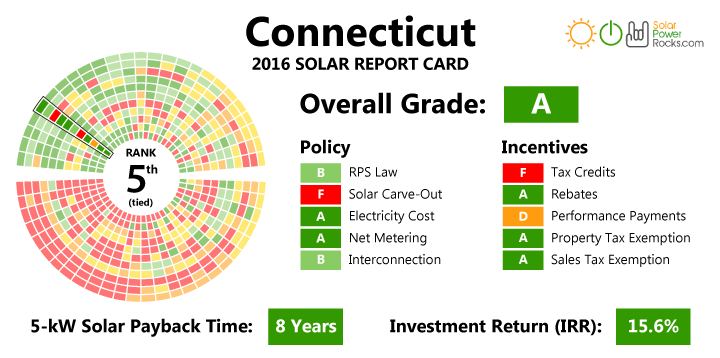

Connecticut Solar Energy Rebates and Incentives

Posted by Brandi Casey on 18th Apr 2017

Despite the its small size, Connecticut is among the top 30 states in terms of population and is the fourth most densely populated state. The state also gets an average of 4.5 hours of direct sunlight per square meter on a daily basis, which is slightly more than New York. Connecticut was also rated top ten in terms of solar capacity as of 2008, which is due in large part to their solar incentives.

Due these factors, Connecticut is an ideal location for renewable energy for both residential and utility sized solar arrays. To encourage installations in both the residential and business the state offers a wide variety of incentives for solar, and wind. Many of the incentives are offered through utility companies, however there are some offered through the state itself. Due to the changing nature of utility incentives, home and business owners are encouraged to inquire with their local utility company and installer for new rebates and incentives.

In terms of state incentives, Connecticut is one of a handful of states that offers a sales tax incentive, which is a 100% exemption on sales tax for renewable products. This incentive is available for solar water heat, solar space heat, photovoltaics, geothermal heat pumps and direct use, other distributed generation technologies, and associated equipment. To claim the exemption, purchasers need to fill out the Cert140 Form and submit it to the Connecticut government website.

Connecticut’s Clean Energy Finance and Investment Authority (CEFIA) introduced a new residential solar investment program in March of 2012, with an update that followed in January of 2013. The program’s goal is to support a total of 30 megawatts of residential solar installations. It is limited to customers of the state’s investor-owned utility companies such as: Connecticut Light & Power and United Illuminating. Homeowners are encouraged to contact their local utility companies to see if they are eligible to participate in the program

Connecticut also offers extensive net metering opportunities

for: solar thermal electric, photovoltaics, landfill gas, wind, biomass,

hydroelectric, fuel cells, municipal solid waste, small hydroelectric, tidal

energy, wind energy, ocean thermal, and fuel cells using solar energy. Under

Connecticut’s net metering program, net excess generation is credited forward

on the customer’s next energy bill at a retail rate, and can be reimbursed at a

wholesale rate.

Rebates and Incentives

|

Industry Recruitment / Support: |

|

|

Local Rebate Program: |

|

|

PACE Financing: |

|

|

Performance-Based Incentive: |

|

|

Property Tax Incentive: |

|

|

Sales Tax Incentive: |

|

|

State Grant Program: |

|

|

State Loan Program: |

|

|

State Rebate Program: |

|

|

Utility Loan Program: |

|

|

Utility Rebate Program: |

|

Rules, Regulations and Policies

| Appliance / Equipment Efficiency Standards: |

|

| Building Energy Code: |

|

| Energy Efficiency Resource Standard: |

|

| Energy Standards for Public Buildings: |

|

| Generation Disclosure: |

|

| Green Power Purchasing: |

|

| Interconnection: |

|

| Net Metering: |

|

| Public Benefits Fund: |

|

| Renewables Portfolio Standard: |

|

| Solar/Wind Permitting Contractor Licensing: |

|

| Solar/Wind Permitting Standards: |

|